The weakest part of the Blink Board experience is probably the remote. That kept the top speed at more like 10 miles per hour, which was much more comfortable, and also wouldn't drain the battery as quickly.

In fact, in my brief time riding it right here in Midtown, I kept switching back to the slower setting on the remote. Other electric skateboards top out at higher speeds, but 15 miles per hour is more than plenty on this smaller style board. It wouldn't get me through the 9-mile bike lane route from my apartment to The Verge's office, for example, but it would be useful for cutting down the 1-mile walk I take to and from the subway every day. Six miles might be enough range for early adopters and enthusiasts, or people with relatively short commutes. Those aren't necessarily deal-breaking issues.

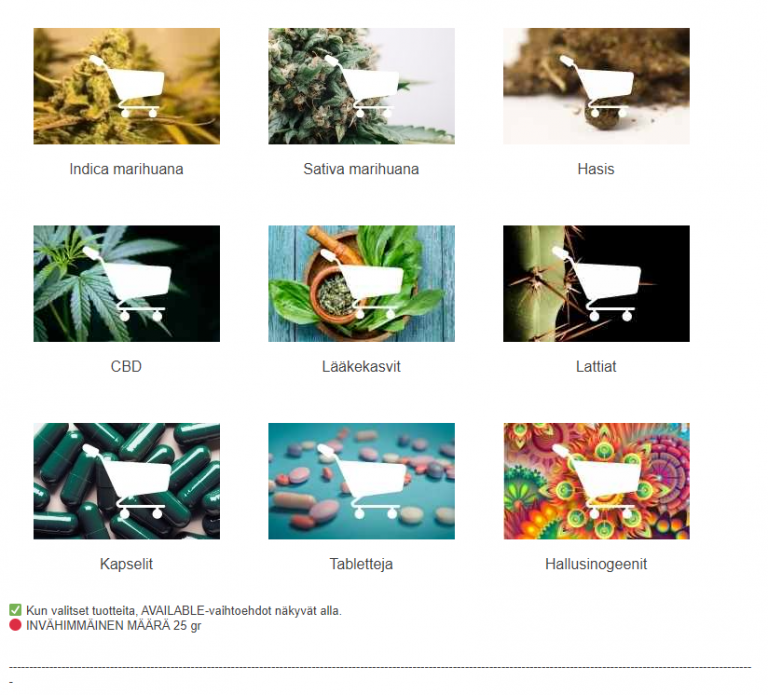

#Blink lite skateboard buy now pay layer full

The Blink Board can go six miles on a full charge, and it tops out at 15 miles per hour, specs that are only on par with the lower-end models offered by companies like Boosted. The petite size comes with a downside, though: the motor and battery combination isn't quite as capable as Acton's competition. The Blink Board weighs just nine pounds, light enough so that it's not a burden to carry around when you're not riding it. The smaller size makes the Blink Board much more maneuverable, and it also makes it an unusually light electric skateboard. It's so much more maneuverable than a longboard The Blink Board, on the other hand, more closely resembles a regular skateboard. Most of the electric skateboards on (or about to reach) the market are well over two feet long, existing somewhere in the size range more traditionally reserved for longboards.

The other thing the Blink Board does a bit differently is size. Next to all of those, the Blink Board seems downright cheap. And MetroBoard, which sells 10 different electric skateboards, only sells two for under $1,000. Yuneec's E-Go starts at $699, but is currently out of stock. The ZBoard 2 and the soon-to-be-released Inboard M1 hover in the same price range. Boosted Boards start at $1,000 and go up to $1,499. Don't get me wrong, $499 is still a big commitment for most people. The Blink Board is only $499 - at least half as expensive as many competitors. The BNPL company may require you to pay the total cost of a purchase until the dispute has been resolved with the merchant, so be sure to read and understand the merchant’s specific return policies and the BNPL loan terms before making a purchase with a BNPL loan.First and foremost is the price. Returning merchandise bought with BNPL loans can sometimes be complicated. For example, BNPL loans don’t offer the same dispute protections as credit cards if the item you purchase is faulty or a scam. Ensure that you can afford the payments before making your purchase and set up a way to make each payment on time.īe aware that BNPL loans lack some of the consumer protections that apply to credit cards. While many BNPL loans don’t charge interest, most do charge late fees for missed payments. Risks related to Buy Now, Pay Later loans Before agreeing to any loan, check the loan documents provided by the lender to understand any fees, charges, and costs for which you may be responsible. This agreement will also generally include terms for late payments, refunds, and an arbitration clause. BNPL lenders will usually provide you with an agreement that includes a payment schedule with payment amounts and due dates. Since most BNPL loans typically have four or fewer payment installments with no interest, BNPL lenders may not provide the standard cost of credit disclosures found in other types of personal installment loans. Your payment history may not be reported to credit reporting companies.

It’s important to read the details of the loan before applying and again before accepting the loan to understand how the loan may impact your credit. However, other types of online installment loans that let you borrow larger amounts of money and pay back over longer periods of time do require hard credit inquiries and report your payment history to credit reporting companies. Most BNPL loans do not require a hard credit inquiry. and have a debit card, credit card, or bank account to make payments.Unlike a credit card, each time you initiate a purchase with a BNPL loan, your creditworthiness may be evaluated.īNPL loan applications require information like name, email address, mobile number, and date of birth. The first payment may be due at checkout or may be due in two weeks. One common repayment plan lets you split the cost of the product into four interest-free biweekly payments. You’ll generally encounter the option to purchase an item using BNPL loans when shopping online or through a mobile app, though they are also available in stores.

0 kommentar(er)

0 kommentar(er)